It is very important to note that when purchasing a property, all the right questions must be asked. Instances can arise where the seller is a VAT vendor and the purchaser not or vice versa. Ultimately this will determine whether the transaction is subject to VAT or transfer duty.

Authored by Marlon Brandon James, MaxProf Audit Manager

Before diving too deep into the topic, one first needs to clearly distinguish between VAT (Value-added Tax) and transfer duty. Provided the seller is a registered VAT vendor, VAT will be levied on the supply of goods or services, whereas transfer duty tax will be levied on the sale of the immovable property in question.

The first aspect to consider is whether the seller is a registered VAT vendor, as this will be the determining factor whether VAT is payable or not. If the seller is a VAT vendor, VAT in this case will be payable on the purchased price by the seller and if the seller is not a VAT vendor transfer duty will be payable by the buyer.

It is also important to note that in cases where the seller is a registered VAT vendor, VAT will not automatically be payable, as the property that the seller intends to sell should form part of their taxable supplies or should be regarded as his or her income-producing asset. In this instance, VAT will be included in the sale of the property.

On the other hand, an instance can arise where the seller is selling private property that does not form part of his or her taxable supplies. In this case, VAT will not be payable and the transaction will rather be subject to transfer duty.

A Broader Understanding of Transfer Duty Tax

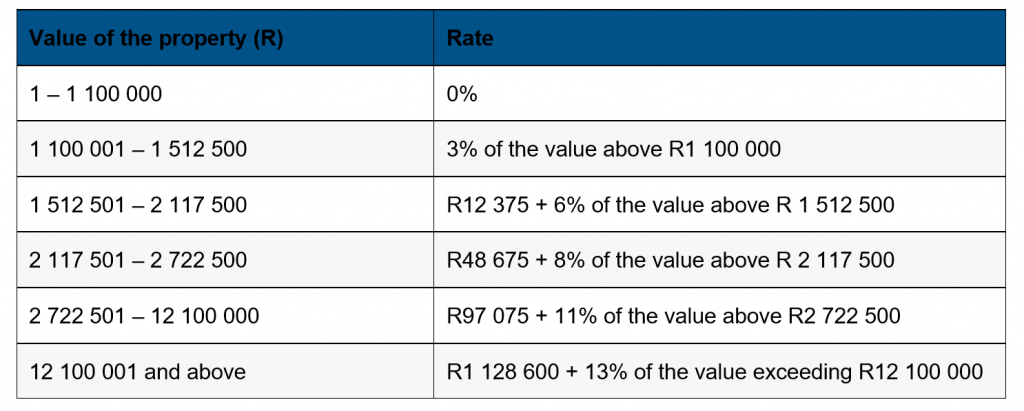

Transfer duty is the tax levied on the value of any property acquired by any person by any means. This ultimately means that whether you buy a property from a seller or acquire it any other way, tax will be payable to SARS.

For example, on a property purchased for R2 million, if the buyer is to pay transfer duty, transfer duty amounts to R41,625 (according to transfer cost calculator). However, if the seller is a VAT vendor and the property is subject to VAT, the buyer could end up paying a purchase price inclusive of VAT to the value of R2 300 000 (The current VAT rate is 15%).

SARS Transfer duty rates – 2024 (1 March 2023 – 29 February 2024):

Going Concern

A matter can arise where the seller is selling property as a going concern and said property forms part of a business. Provided both parties involved are registered VAT vendors, VAT will still be payable, however at a zero rate. This will ultimately entail that no VAT, nor transfer duty will affect the transaction.

It is important to note that for VAT to be payable at a zero rate, the following qualification criteria have to be met:

A divestiture must occur where the essential assets used to carry out the business function must be disposed to the purchased party from the seller of the property.

The enterprise must be an enterprise as defined in the Act (for practical purposes must be an enterprise where one is obliged to pay VAT on the income), and the enterprise must be an income-earning activity on the relevant effective date. It would be wise in such instances to include a clause along the following lines in the contract for the sale of the business to ensure that the Receiver of Revenue will in fact agree that the VAT in the transaction should be zero-rated: –

“1. Both parties hereby warrant that they are registered as vendors in terms of Section 23 of the Value-Added Tax Act No. 89 of 1991 (“the Act”). The parties record that: –

(a) The business together with the assets and the stock-in-trade constitutes an enterprise as the term is defined in the Act, and the supply of the enterprise as contemplated herein is that of a going concern chargeable with value-added tax (“VAT”) at zero rate in terms of Section 11 (1)(e) of the Act.

(b) The enterprise shall be an income-earning activity on the effective date, it being recorded that all of the assets which are necessary for the carrying on of such enterprise are hereby simultaneously being disposed of by the Seller to the Purchaser.

2. In the event of VAT being levied at a rate other than zero, the VAT so payable shall be paid by the Purchaser to the Seller on demand, provided that the Seller furnishes the Purchaser with a VAT invoice as contemplated in the Act to enable the Purchaser to claim an input credit in respect of the VAT so paid.”

Residential Properties

If the firm is a residential property company, transfer duty applies to the purchase of shares in the company. A company that owns residential real estate is said to be a residential property firm if the fair market value of the real estate represents more than 50% of the total fair market value of the company’s holdings/ assets.

Keep in mind that unless the seller is a VAT vendor, in which case the acquisition of a share in a share block business will be liable to VAT, all share purchases are subject to transfer duty.

Conclusion

It is essential to note that before purchasing immovable property, all information surrounding the purchase should be clearly understood when determining if the transaction is subject to VAT or transfer duty tax, as an unclear understanding can negatively impact both parties involved, resulting in additional fees.