Written by Tevlon de Lora, MaxProf Auditor

For most working South Africans, Pay As You Earn (PAYE) is the way income tax is paid. Instead of paying tax once a year, employees have a portion of their salary automatically deducted each month by their employer and paid directly to the South African Revenue Service (SARS). This system makes it easier for individuals to meet their tax obligations without needing to worry about a large lump-sum payment at the end of the year.

Despite its convenience, many people don’t fully understand how PAYE is calculated or why their take-home pay sometimes changes. Knowing the basics of how PAYE works can help you read your payslip with confidence, plan your finances better, and avoid surprises during tax season.

So, How Is PAYE Calculated?

The PAYE amount deducted from your salary depends on a few key factors:

- Your total monthly income

The more you earn, the higher the percentage of tax you’ll pay. South Africa uses a sliding scale, which means people who earn more are taxed at a higher rate.

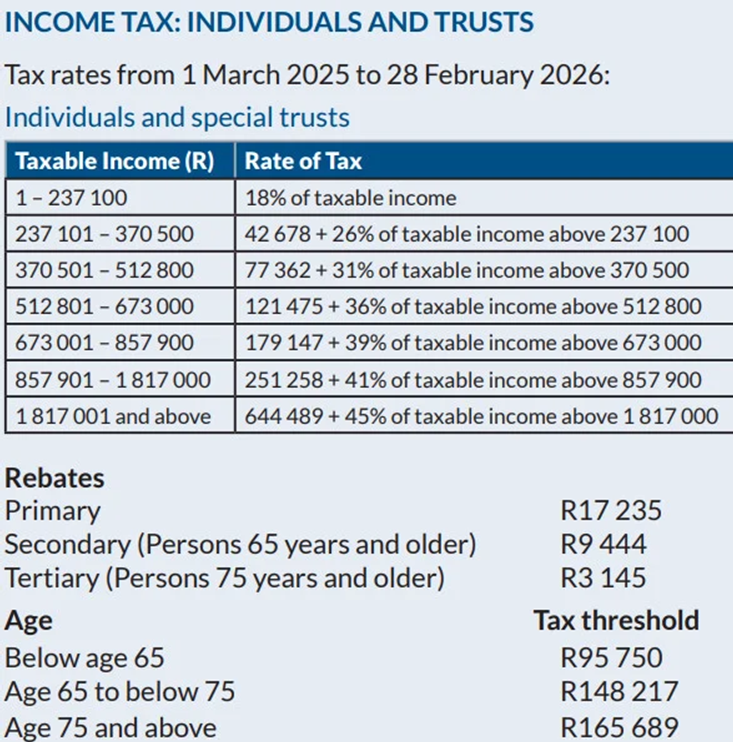

- The SARS tax tables

Every tax year, SARS releases income tax brackets that show how much tax should be paid at each income level. These brackets are used to work out how much tax applies to your income.

- Your tax rebate

Everyone gets a basic tax rebate (a reduction in the amount of tax you owe). This rebate is automatically considered when calculating your monthly PAYE, helping to reduce the total tax deducted.

- Allowable deductions

If you contribute to things like a pension fund, retirement annuity, or medical aid through your employer, these can reduce your taxable income—meaning you pay less tax.

An Example to Make It Simple

Let’s say you earn R20,000 per month before deductions:

- SARS looks at the annual equivalent (R20,000 x 12 = R240,000 per year).

- Find the Applicable Tax Bracket:

As seen on the table above, this income falls into the second tax bracket:

R237,101 – R370,500

Tax = R42,678 + 26% of the amount above R237,100

Let’s calculate it:

- Amount above R237,100:

- R240,000 – R237,100 = R2,900

- 26% of R2,900 = R754

Add to base amount:

R42,678 + R754 = R43,432 (annual tax before rebate)

- Subtract the Primary Rebate

- Annual tax: R43,432

- Less primary rebate: R17,235

- Tax payable after rebate: R26,197 per year

- Divide by 12 for Monthly PAYE

- R26,197 ÷ 12 = R2,183.08

So, the monthly PAYE deduction would be approximately R2,183, assuming there are no other deductions or benefits affecting taxable income.

Common Misconceptions Individuals Have When It Comes To Tax Returns

Now that we have an understanding as to how the deduction is calculated, let us have a look at common misconceptions individuals have when it comes to calculating and submitting tax returns.

Q: Is my employer responsible for submitting my tax return?

A: No, the onus is on the taxpayer to submit their own returns. The responsibility employers have is to deduct the money and pay it over to SARS, they also must submit bi-annual reconciliations to reconcile the amount deducted from employees to what has been paid over to SARS and you will be issued with an IRP5 at the end of the tax year as proof it has been paid.

Q: Am I allowed to claim all out of pocket medical expenses?

A: No, only individuals that belong to a recognised medical scheme are allowed to the deduction if the medical aid did not cover prescription medications and certain professional health service fees.

Q: Why do I have to pay additional tax when I submit my tax return, did my employer not deduct everything?

A: It is imperative to note that your employer is only aware of the income you receive from them. Any other additional income streams are your responsibility to declare to SARS, an example would be rental income. This could mean that you will have to pay more tax, but along with declaring the income received you will be able to deduct expenses relating to generate the relevant income.

Q: Am I entitled to a refund?

A: The simple answer is no. As SARS will look at your taxable income which includes items like lump sumps received from pension funds, provident funds, annuities and even withdrawals from the two-pot system. Thus, your taxable income will be more than what your employer used to calculate the PAYE deduction.

Tax Deductions That Can Help You Pay Less

Filing a tax return is often seen as a chore, but it is also an opportunity. The Income Tax Act No. 58 of 1962 provides individuals with a range of deductions that can reduce their taxable income, lowering the amount of tax they ultimately pay. Knowing what you can claim — and keeping the right records — ensures you don’t miss out on relief that you are legally entitled to.

Here are some of the most common deductions available to South African taxpayers:

- Retirement Fund Contributions

Contributions to pension, provident, and retirement annuity funds are deductible within certain limits. Section 11F allows a deduction of up to 27.5% of the greater of taxable income or remuneration, subject to an annual ceiling of R350,000. Any contributions above this threshold are not lost; they can be carried forward to future years. This deduction provides two advantages: immediate tax savings and the reassurance that you are investing in your financial future.

- Medical Aid Contributions and Expenses

Medical-related relief comes in two parts. Section 6A provides a monthly Medical Scheme Fees Tax Credit (MTC), a fixed amount available for the taxpayer, their spouse, and dependents. Section 6B then provides additional relief for qualifying out-of-pocket medical expenses, which can be claimed if they exceed certain thresholds. These thresholds are more favourable for taxpayers over 65 or those with a disability.

- Donations to Public Benefit Organisations

Supporting good causes can also benefit you at tax time. Under section 18A, donations made to SARS-approved Public Benefit Organisations are deductible up to 10% of taxable income before donations. To claim this deduction, it is essential to obtain a section 18A certificate from the organisation. Without this certificate, the deduction cannot be allowed.

- Home Office Expenses

For those who work from home, certain expenses may qualify as deductions. Section 11(a) allows the deduction of expenses incurred in the production of income, but section 23(b) places strict conditions. The home office must be used regularly and exclusively for work. If these requirements are met, a proportion of costs such as rent or bond interest, rates and taxes, electricity, and office equipment may be claimed. This deduction is particularly relevant to taxpayers who earn mainly commission-based income.

- Travel Allowance

Many employees receive a travel allowance from their employer, reflected on the IRP5 under code 3701. Section 8(1)(b) allows individuals to claim a deduction for business travel undertaken in their private vehicle. To do so, a detailed logbook must be kept, recording both business and private kilometres travelled. SARS allows the deduction to be calculated either on actual costs or on the prescribed rate per kilometre published each year. Importantly, ordinary commuting between home and the office does not qualify as business travel. If no logbook is submitted, SARS will treat the entire allowance as taxable income, which often leads to a higher tax liability.

Tax season does not need to be intimidating. By separating fact from fiction and understanding how PAYE is calculated, deductions, and allowances really work, you can take charge of your finances instead of being caught off guard by them. The key is awareness: knowing that your employer is not responsible for filing your return, that not all expenses automatically qualify, and that refunds are not guaranteed helps set realistic expectations. At the same time, recognising the deductions available to you ensures you can drastically reduce your liability.

Ultimately, the more informed you are, the better equipped you become to reduce your tax burden and keep more of your hard-earned income. With accurate records, a bit of planning, and perhaps professional guidance when needed, you can transform tax season from a stressful obligation into a smart financial opportunity.