Written by Marlon James, MaxProf Senior Auditor

Understanding VAT and Transfer Duty in Property Transactions

When purchasing a property, it is crucial to ask the right questions to determine whether Value-Added Tax (VAT) or transfer duty applies. The applicable tax depends on whether the seller is a VAT-registered vendor or not.

VAT vs. Transfer Duty: What's the Difference?

- VAT (Value-Added Tax) applies when the seller is a registered VAT vendor and the property is part of their taxable supplies.

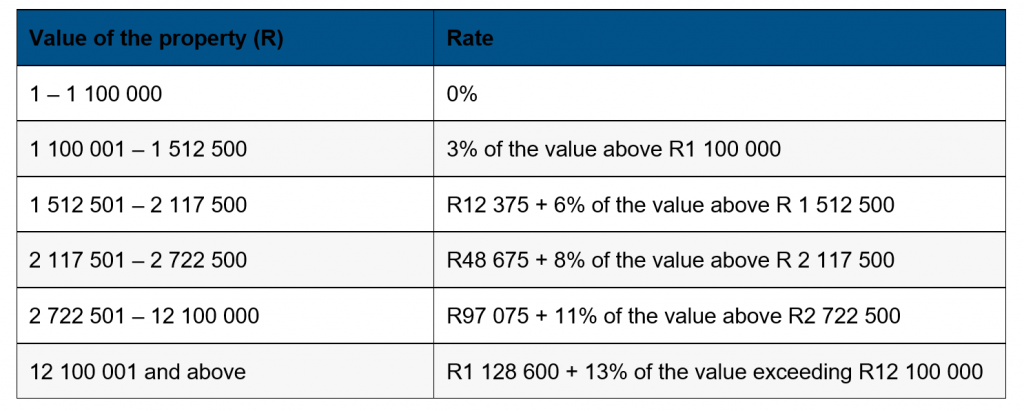

- Transfer Duty is payable when the seller is not a VAT vendor and is levied on the sale of immovable property.

When Is VAT Payable on Property?

- If the seller is a VAT vendor, VAT is included in the purchase price and must be paid by the seller.

- If the seller is not a VAT vendor, transfer duty applies, and the buyer is responsible for the tax.

- VAT is only applicable if the property forms part of the seller’s taxable supplies or income-generating assets.

Example of VAT in Property Transactions

- If a registered VAT vendor sells a property worth R2,300,000, the price includes VAT at 15%.

- If the seller is not VAT-registered, the buyer pays transfer duty of R41,625 on a property worth R2,000,000 (as per SARS’ transfer duty rates).

What Is Transfer Duty and When Does It Apply?

Transfer duty is a tax levied by SARS on property transactions where VAT is not applicable.

Key Transfer Duty Considerations

- Payable by the buyer when purchasing property from a non-VAT vendor.

- Transfer duty rates are based on the property value.

- Applies to residential property purchases, including share block companies.

What Happens If the Property Is a Going Concern?

A going concern refers to a business that is sold as a functioning entity, including its assets and property.

VAT on Going Concerns

- Both buyer and seller must be VAT-registered.

- VAT is charged at a 0% rate if the business is a qualifying enterprise.

- A clause should be included in the contract confirming the zero-rated VAT status under Section 11(1)(e) of the VAT Act.

Example: If a VAT-registered company sells a rental property business as a going concern, the buyer pays no VAT or transfer duty, provided all qualifying criteria are met.

VAT vs. Transfer Duty on Residential Properties

- If a residential property company sells shares in a company owning real estate, transfer duty applies.

- If the seller is VAT-registered, VAT is payable instead of transfer duty.

- If more than 50% of the company’s total asset value is in residential property, the sale is treated as a property transaction for tax purposes.

Conclusion

Before purchasing a property, it is essential to determine:

- Is the seller a VAT vendor?

- Does the property form part of their taxable supplies?

- Is the transaction subject to VAT or transfer duty?

A clear understanding of VAT and transfer duty will help buyers and sellers avoid unexpected costs and ensure compliance with SARS regulations.